New data shows burden shift of 2023 reassessment appeals

Information provided by the Cook County Assessor’s Office

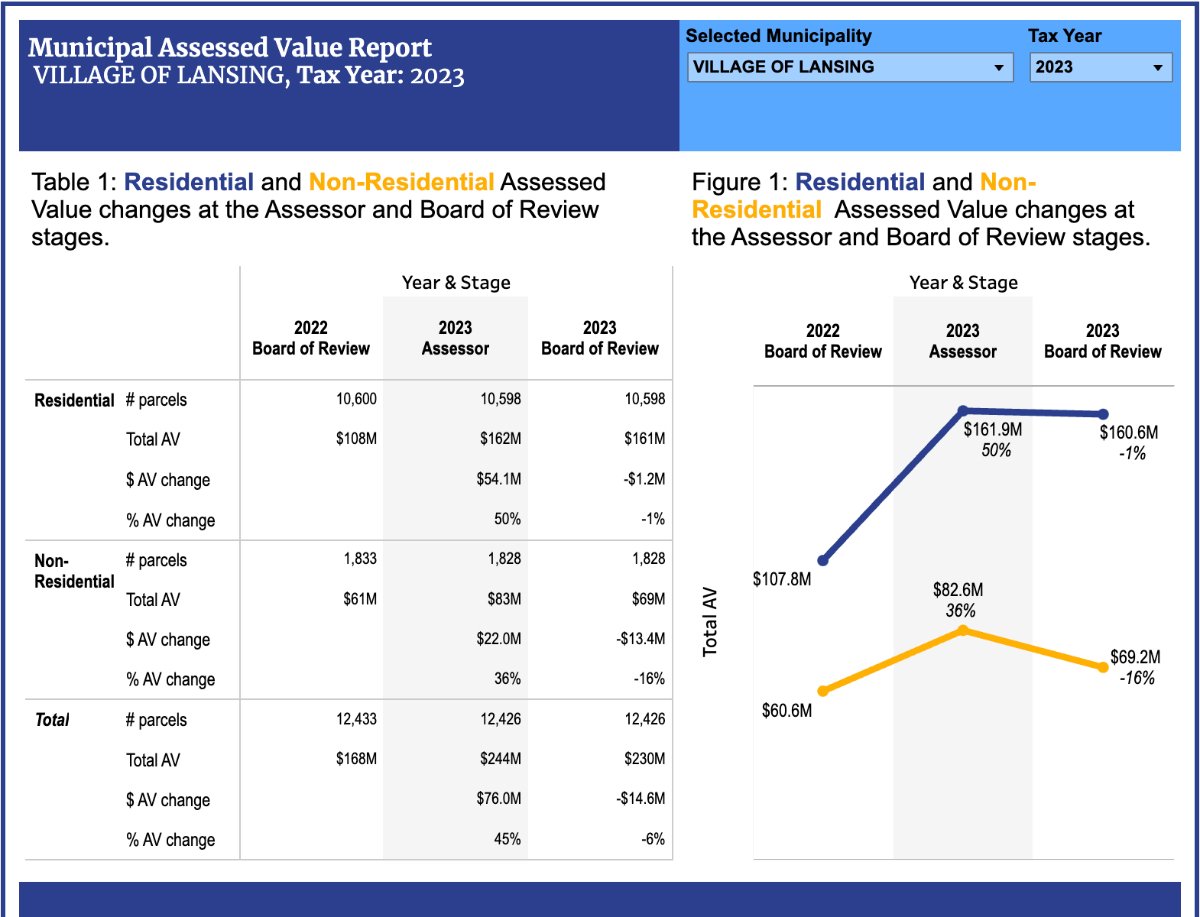

COOK COUNTY, Ill. (July 1, 2024) – The Cook County Assessor’s Office (CCAO) has released a new set of Data Dashboards for townships and municipalities showing the effect of appeals with the Cook County Board of Review (BoR) on assessed values during the 2023 reassessment cycle.

Prior to the reassessment, residential property made up 68% of total assessed value, while non-residential made up 32%. After the CCAO set values and processed appeals in the south and west suburbs, homeowners’ share would have dropped slightly, to 67%. Because share of assessed value can correspond to share of tax burden, a drop in homeowners’ share could mean a drop in the share of tax burden.

However, the CCAO is not the final arbiter of assessments in Cook County – the BoR has the ability to change property values during the appeals process.

Following appeals with the BoR, the residential share of total assessed value increased to 71%. This was mainly because of appeals granted to non-residential properties: In total, the assessed value of non-residential property decreased $950 million, or just over 18%, during the BoR appeals stage.

These changes in the distribution of the property tax burden could affect many of the second installment tax bills issued to homeowners in the coming weeks. Assessed values are used to calculate the tax base for individual taxing districts that, together with the levy, determine the tax rate. (Other factors, such as Tax Increment Financing districts, exemptions, the multiplier, and the “recapture” provision, also affect tax rates.)

As a result of BoR appeals, homeowners in many parts of the south and west suburbs will take on a larger share of the tax burden — and a greater increase in their property taxes — than they would have under the CCAO’s values.

Variations within townships

Appeal changes varied significantly between each of the 17 townships that were part of the 2023 south suburban triennial reassessment. But the same pattern held throughout — in each township, homeowners saw their share of assessed value increase following appeals with the BoR.

In Bloom Township, which includes the southern part of Lansing, residential property made up 65% of assessed value before the reassessment. The CCAO’s assessments increased total assessed values across the township by about $215 million, and decreased homeowners’ share of this value to 64%.

In townships where residential property makes up the vast majority of the tax base, changes on appeal were less drastic but followed the same trend as elsewhere. In River Forest Township, for example, homeowners increased from 88% to 90% of the share of assessed value following appeals with the BoR.

In individual south and west suburban municipalities, many of the same patterns held. Chicago Heights, Stickney, and Phoenix all saw homeowners take on a share of assessed values that was 9-10 percentage points greater under the Board of Review’s final values than the CCAO’s. It was only in Ford Heights that residential property’s share of value decreased following BoR appeals.

The CCAO Data Dashboards

The Data Dashboards created by the Cook County Assessor’s Office allows the public to view assessed values in Cook County at each stage of the assessment process. The dashboard demonstrates changes in total assessed values at each stage of the assessment process since last year. In the first stage, the Assessor’s Office sets values and processes appeals. In the second and final stage, the Board of Review adjusts those values based on appeals filed in their office. Each dashboard provides a clear view of how the tax burden is split between residential and commercial property owners and the effects of appeals.

More information about the property classes is available in the “Appendix” tab in the dashboard.

The CCAO has released Data Dashboards since 2020 for townships and municipalities within Cook County. To explore all the publicly available data, visit www.cookcountyassessor.com/dashboard.